In part 1 of our blog series on IIA’s framework for self-service analytics, we explored how to the lay groundwork for self-service within the unique history, culture, and characteristics of your organization. Now that we’ve surfaced your data consumers’ assumptions about data and analytics, it’s time to move to next steps of demand segmentation, behavioral incentives, and identifying demand for advanced analytics and AI.

IIA RAN clients have access to the full self-service framework and supplemental resources here.

Segmenting the Audience

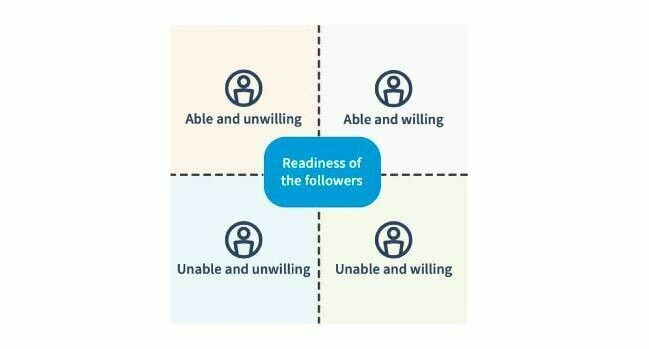

A self-service initiative is fundamentally about managing change. It requires a deep understanding of the demand side's willingness and ability to adopt new practices. You've defined self-service and gauged whether your stakeholders are on the same page or have different expectations. Now, you face the delicate task of assessing and openly discussing the readiness of individuals and departments. It's about candidly evaluating whether they are truly ready to embrace self-service, or if their enthusiasm wanes when confronted with the actual work, like building a dashboard. Navigating this requires tact and honesty about their current capabilities.

You are going to determine where your demand side fits within four categories of potential partners to the effort:

- Willing and Able

- Willing and Unable

- Unwilling and Able

- Unwilling and Unable

After categorizing your constituents based on their self-service readiness, consider their influence and capacity to lead change, recognizing that the analytics function may not hold sway. The obvious choice may seem to partner with the willing and able, but don't overlook the strategic value of engaging influential yet currently unwilling parties, like a busy sales team at year-end. Integrating them peripherally, by sharing progress with other departments or planning skill-building for a future federated analyst team, could prepare them for eventual involvement. This approach also helps gauge the level of resistance and determines whether their unwillingness is situational or indicative of a longer-term stance.

Your initial partners will primarily be those who are both willing and able, supplemented by a strategic choice of others. The remaining groups will likely gravitate toward your initiative as they observe its successes with these early adopters.

Segmenting Your Analytics Demand eBook

In transitioning to a demand orientation, analytics leaders will quickly become aware that the demand side is multifaceted and that no two demand constituent groups are the same, creating complexity when trying to develop demand-based analytics strategies. To ameliorate this, experts at IIA have identified the 10 critical dimensions to a segment and explained them in this eBook, allowing you to better understand where your current demand segments are and where your target demand segments should sit.

Incentives for Adoption

Transitioning users from a familiar present to an uncertain future is a challenge, particularly without leverage over their rewards. Successful self-service project leaders must therefore offer incentives, favoring enticements over mandates. It’s a common oversight to assume universal eagerness for self-service; some, like finance or marketing, may be content with the current system that serves their needs without added responsibility. Recognizing that the status quo benefits certain users is crucial for strategizing effective incentives to drive change.

Start with a clear transition period and phase-out of old systems, making it known that desired behaviors will be encouraged and undesired ones discouraged, directly impacting those resistant to change. Craft tailored incentives for different user groups. For instance, if finance is identified as reluctant yet capable, devise specific motivators for their participation. The ultimate aim is to divest from routine reporting duties to concentrate on advanced analytics and AI. Every traditional request impedes this strategic shift, so incentives should align with accelerating this transition for all, particularly for departments like finance.

For your finance group you can be creative in how you work with them. For example:

Subsidize the behavior you want

- Create a certification for anyone who goes through training on your new self-service platform

- Give greater input on changes to the set of remaining standard reports, during feedback windows from all parties

Tax the behavior you don’t want

- Charge finance $5,000 (for example) per month for every month they do not move to the self-service platform and use that money to develop training for more colleagues to advance on the platform

- Ratchet down their on-demand requests allowance coupled with increasing costs over that limit, e.g., Q1 $5,000 for 20 requests, Q2 $7,000 for 15 requests, etc.

Identifying Demand for Advanced Analytics and AI

Up until now, your efforts have been to empower the demand side to embrace self-service, liberating your analytics team from the drain of repetitive reporting tasks and allowing you to focus on the higher-value domain of advanced analytics. As the self-service framework solidifies, it's essential to pivot toward nurturing a demand for advanced analytics and AI. While fostering a culture that appreciates the nuances of predictive and prescriptive analytics may seem disconnected from the practicalities of self-service, it's a critical progression. This strategic foresight ensures that AI doesn't remain a concept but becomes an operational reality.

This is where you revisit the business intelligence challenges that your business units have self-identified in step one—surfacing assumptions. These are not just issues to be resolved but also seeds for your advanced analytics project pipeline. While fully fleshing out a pipeline might be a stretch goal at present, starting to scope and define potential advanced analytics endeavors with stakeholders who are already on board sets a constructive trajectory. Engaging with these problem states and their respective owners now can provide a roadmap for where your analytics capabilities could eventually make a significant impact.

However, be aware that at this stage, you are selling futures, due to lack of competency, time and perhaps technology, and should further be aware that the projects you chase need an outsized ability to influence those you need to sponsor future efforts.

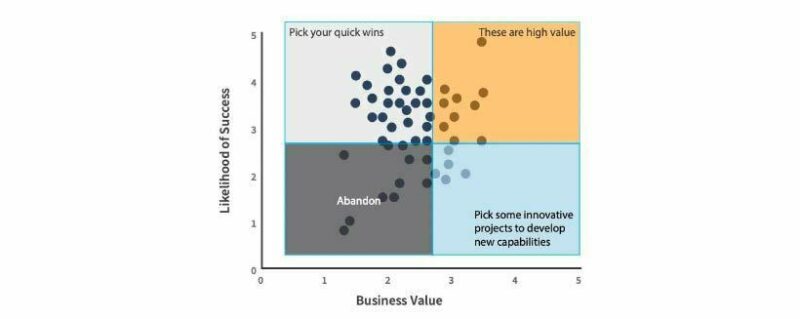

Right now is about finding internally saleable wins. One way to focus the new “blue sky” of AI is to think about potential projects as fitting into three categories:

- Do they have demonstrable (marketable) business value?

- Can you actually pull it off?

- Will the project demonstrate the unique value of advanced analytics and AI, as opposed to prior BI efforts?

A Framework For Establishing A Self-Service Program eBook

The road to self-service requires flexibility, agility, and resilience as you both incent and compel the demand side to embrace these efforts. To find success with self-service initiatives, IIA recommends leveraging a four-element framework explored in this eBook:

Surface Assumptions: Identify and classify the underlying assumptions about the self-service effort and ground it in an explicit, publicly declared and validated rationale.

Segment Audience: Segment the user audience to understand who this effort is designed to benefit and whether or not your constituents are ready and willing for this self-service effort.

Incentives for Initiatives: Establish an incentivization structure that favors a defined cutover period and developing explicit incentive schemes for each segment

Identify Demand for Analytics: Once you have enabled your demand side to self-service, you must turn your focus to enabling an advanced analytics program by looking for saleable wins.

Questions for Your Data Consumers

Your self-service initiative is a stepping stone toward enhanced analytics maturity, heavily reliant on the shift from on-demand service to proactive self-service. Discussions with users are key—they not only clarify business needs and the required detail in data or tools but also identify which reports to automate or phase out. Such dialogues may reveal the misuse of descriptive analytics as predictive, guiding your strategy. Approach these conversations with open-ended questions, minimally detailed, for better clarity. You might cross-reference conversational insights with usage stats to confirm the most relied-upon reports, fostering a data-driven approach to refining your analytics offerings.

- What are your top reports, the ones you rely on most?

- Why are these reports so valuable?

- If you could make these reports better, how would you do so?

As you progress toward greater analytics maturity, adopt a structured approach that:

- Highlights the most impactful business analytics efforts, emphasizing that business impact is the ultimate goal.

- Facilitates discussions on analytics potential with stakeholders, pinpointing where knowledge gaps lie.

- Allows your team to deliver current projects efficiently while building future capabilities.

- Provides a visual roadmap of stakeholder dialogues, enabling you to revisit and validate assumptions about each initiative's business gains and contributions to analytics maturity.

When determining potential analytics projects, consider three factors. Business value, though unique to each organization, typically relates to attributes that bolster corporate strategies by boosting revenue or cutting costs. Secondly, the likelihood of success is reflective of your company's execution capabilities, encompassing skill availability, data accessibility, and the eagerness to act on insights. Applying a simple grading from 1 to 5 to these elements, you can generate a scatter plot to assess whether the business problems you're tackling are high-value and feasible or if a more compelling selection is needed.

The role of innovation grows as you solidify your advanced analytics and AI practice. Initially, it may take a back seat to strategic project selection for influencing key stakeholders. Yet, it's the pursuit of innovation that maintains your team's engagement and pushes the boundaries of the value they deliver. As you grow more adept at new techniques and identifying uncharted business issues, innovation becomes crucial. By mapping business value, likelihood of success, and innovation transparently, you help the demand side understand and vie for your team's focus, with high-priority projects emerging in the upper right quadrant. Engage with these, but also consider easy wins from the upper left and those spurring innovation from the lower right, while steering clear of the less promising bottom left quadrant. This clarity should inspire the demand side to refine their proposals, aiming to rise to the top of your priority list.

Final Thoughts

It’s important for leaders who use this framework to know that the road to self-service is never straight or smooth—flexibility, agility, and resilience will be needed. After all, deploying a self-service effort is an enterprise-wide initiative requiring individuals to change the way they do their jobs in fundamental ways. And while change is never easy, in this case the data is clear: it’s worth it.